Which ECCN Do I Use?

- clarkespositolaw

- Aug 26, 2020

- 4 min read

The US Department of Commerce has empowered the Bureau of Industry and Security (BIS) with advancing national security, foreign policy and economic interests through developing export control policies, issuing export licenses and developing programs to track the US industrial base. The Export Administration Regulations (EAR) subchapter of Federal Regulation Title 15 (15 CFR) sets forth all of the relevant guidelines that BIS uses for their restrictions. Generally, most commercial items subject to EAR are classified under EAR99 and require no filing for licenses except in special circumstances. All other exported goods under EAR are regulated through the Commerce Control List (CCL) and must be technically described using the Export Control Classification Number (ECCN) system. This system assigns a code to regulated goods based on their category, product group and type of control. Each aspect of a classification number, starting from category number then product letter and finally control number, is gradually more specific.

Categories

0- Nuclear and Miscellaneous 6- Sensors and Lasers

1- Materials, Chemicals, Microorganisms and Toxins 7- Navigation and Avionics

2- Materials Processing 8- Marine

3- Electronics 9- Aerospace and Propulsion

4- Computers

5- Telecommunications and Information Security

Products

A- Systems, Equipment and Components D- Software

B- Test Inspection and Production Equipment E- Technology

C- Material

Types of Control

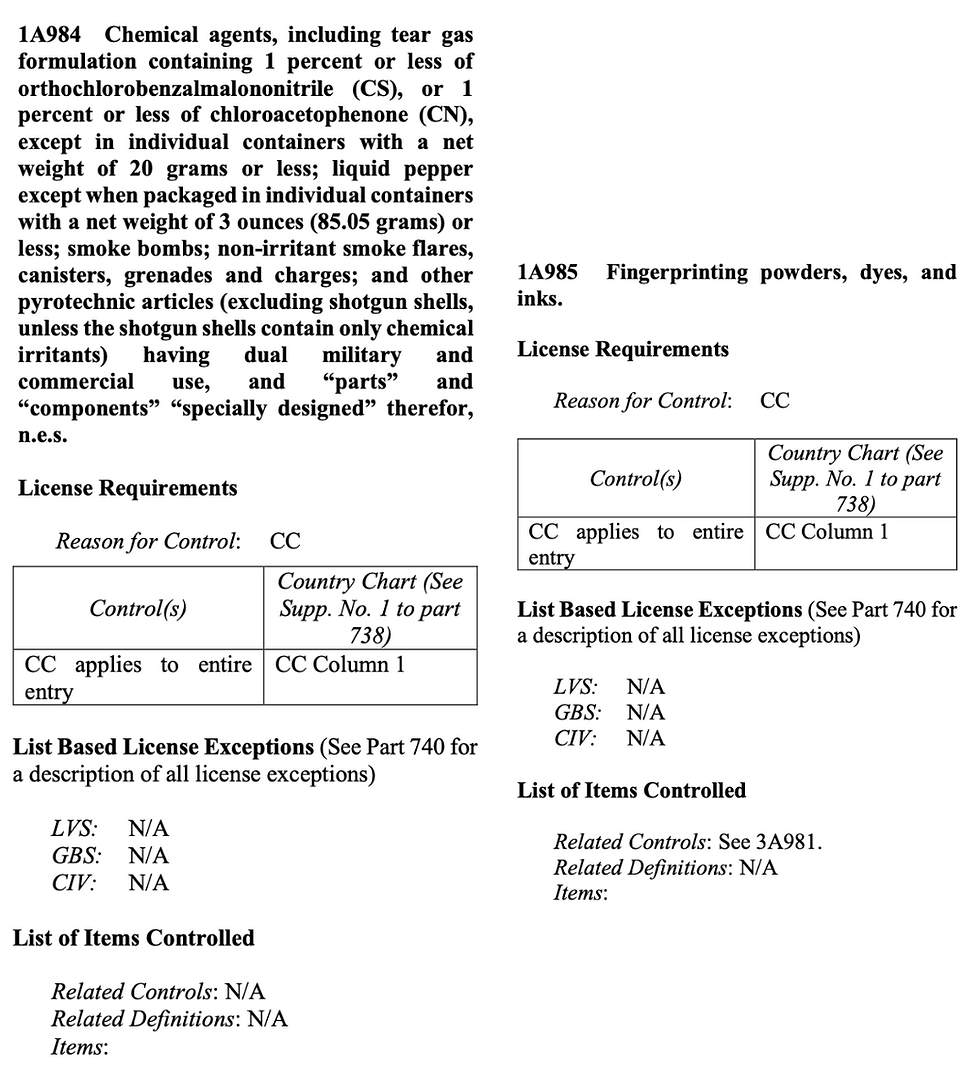

The final three digits of an ECCN refers to the specific control of the given item type within the selected category and product. Given below are two examples of two different controls that have the same category and product.

Both ECCN's are classified under category 1, materials, chemicals, microorganisms and toxins, and product A, systems equipment and components. Each type of control is in the 900's so the ECCN's would be classified as part of the 1A 900 series. Each of the controls are very specific but are regulated in similar ways because the items are regulated for crime control reasons, which is further explained below.

Reason for Control

Under each ECCN there are codes for the reason for control. In the examples given above the reason for control is annotated as CC which stands for Crime Control. The full list of reasons for control and further elaboration on each is given in Part 738 of the EAR. The full list of all fourteen reason for control codes is below.

• AT- Anti- Terrorism • NP- Nuclear Nonproliferation

• CB- Chemical and Biological Weapons • NS- National Security

• CC- Crime Control • RS- Regional Stability

• CW- Chemical Weapons Convention • SI- Significant Item

• EI- Encryption Item • SL- Surreptitious Listening

• FC- Firearms Control • SS- Shorty Supply

• MT- Missile Technology • UN- United Nations Embargo

The reason for control can be used to determine the right classification in relation to the end use of the cargo. As noted above the reason for control can also be used alongside the Country Chart to determine if a license is needed to send the goods to the specified country of a transaction. Checking the Country Chart is one of the final steps in the overall process of assessing the need for a license. The exporter determines the classification of the goods when filing the Electronic Export Information (EEI) in the Automated Export System (AES) so it is important to choose the appropriate ECCN to avoid the risk of delaying the movement of the cargo or being charged with a violation.

The item may not be included under the ECCN system so that would mean it is classified under EAR99. EAR99 classifies most commercial items, many of which have no license requirement. An item may be classified under both the EAR99 and the ECCN system due to varied end uses. Items that are classified under EAR99 have a much more manageable filing process and often only need to be searched in the Code of Federal Regulations here. It is important to read all relevant regulations as a specific destination such as a prison or a wildlife preserve may prompt the exporter to use an ECCN classification.

If an exporter is confused about how they should classify their cargo, they can schedule a Commodity Classification with the Commerce Department but this is a very lengthy process. BIS offers an interactive online tool which goes through the process of classifying a transaction and assists in finding the appropriate ECCN if necessary. BIS also has their Simplified Network Application Process-Redesign program (SNAP-R) which allows exporters to submit export license applications, commodity classification requests, reexport license applications, and license exception notifications for agricultural commodities via the Internet. Once cargo has been processed the transaction will be entered into BIS’s Commodity Classification Automated Tracking System (CCATS). Cargo being processed into CCATS allows exporters to have a less laborious experience when conducting the same or a very similar transaction in the future as they will be able to obtain all of the prior filed information moving forward.

Have questions related to anything you've read above? Feel free to connect with us using the Contact form at the bottom of the Home page.

.png)

Comments